Floyd Mayweather isn’t just known for his undefeated boxing record—his post-ring ventures have sparked controversy and heated debates.

From promoting controversial crypto projects to being embroiled in lawsuits, many headlines have questioned the legitimacy of his business endorsements.

In this guide, we dissect the most notorious controversies, analyze legal disputes, and offer a data‑driven look into the whirlwind of allegations that have come to be known as the “Floyd Mayweather scam.”

In this article, you’ll discover:

- What happened? A step‑by‑step overview of the major controversies.

- Key legal battles: The Centra Tech ICO, EthereumMax lawsuit, and more.

- Expert analysis: How celebrity endorsements can fall into legal gray areas.

- Investor takeaways: How to spot potential scams and protect your investments.

Whether you’re a boxing fan, an investor, or simply curious about the buzz, read on for an in‑depth exploration of these high‑profile controversies.

Overview of Floyd Mayweather’s Transition from Boxing to Business

Floyd Mayweather’s career beyond boxing has been as eventful as his performance in the ring.

Known for his flamboyant lifestyle and entrepreneurial flair, Mayweather has leveraged his celebrity status to endorse a variety of business ventures.

However, his forays into the world of finance and crypto have not been free from scrutiny.

Mayweather’s name carries considerable weight, making any association with his projects newsworthy. His high‑profile endorsements of cryptocurrency projects have drawn regulatory attention.

However, multiple lawsuits and financial disputes have painted a complex picture of his business dealings.

These diverse endeavors, however, have also led to allegations that some of these ventures were not entirely above board—a theme that plays a central role in the narrative behind the “Floyd Mayweather scam.”

The Centra Tech ICO Controversy

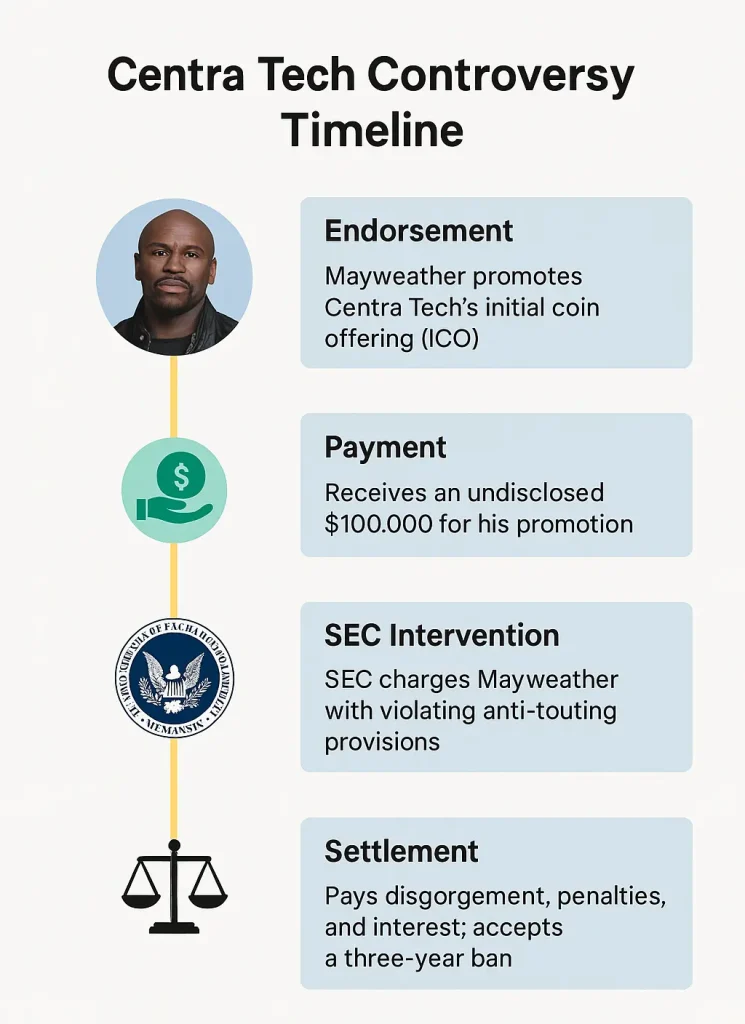

In 2017, during the height of the cryptocurrency boom, Mayweather endorsed Centra Tech’s Initial Coin Offering (ICO).

Promoted as a revolutionary financial platform, Centra Tech quickly attracted attention from both investors and regulatory bodies.

Mayweather was paid $100,000 for his promotion, which he failed to disclose. This omission was a clear violation of the SEC’s anti‑touting rules.

The U.S. Securities and Exchange Commission (SEC) however, took issue with the undisclosed endorsement, eventually forcing Mayweather to settle.

As a result, he paid disgorgement, penalties, and interest, and accepted a three‑year ban from endorsing any other securities.

This incident is a textbook case of how failing to adhere to transparency guidelines can lead to severe legal repercussions, not just for crypto startups but for any celebrity endorsers working in financial markets.

The case has since become an example cited by regulators and financial experts alike when cautioning against undisclosed endorsements.

Quick Tip: Always disclose any compensated endorsements to maintain trust with your audience and abide by legal guidelines.

The EthereumMax Lawsuit: When Celebrity Endorsements Backfire

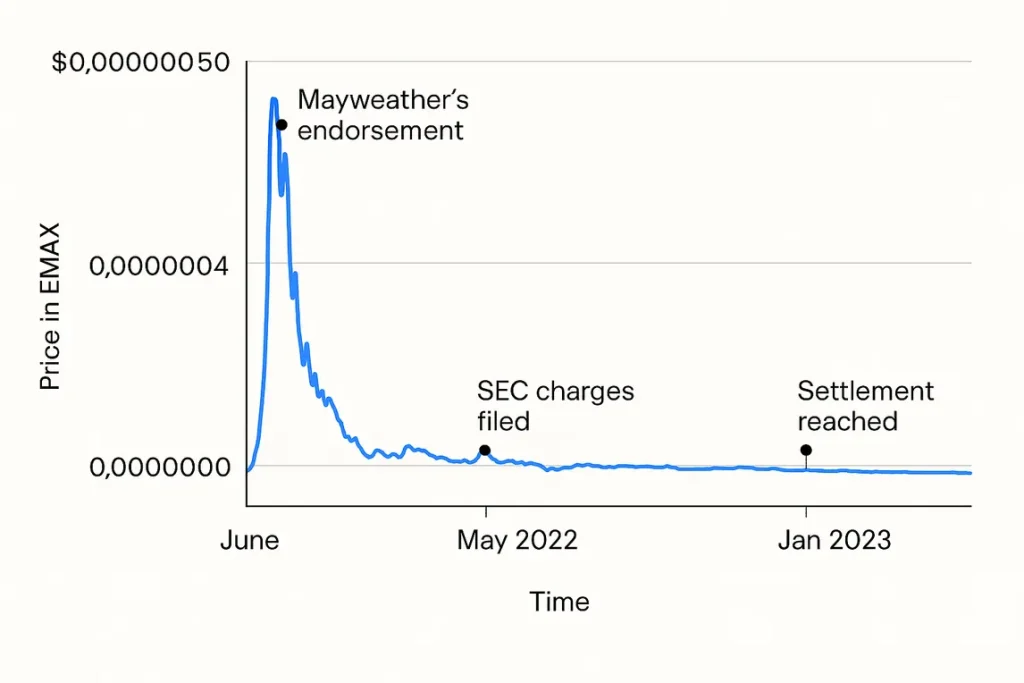

In 2021, a high‑profile class‑action lawsuit was filed against Floyd Mayweather alongside other celebrities—including Kim Kardashian and Paul Pierce—over their promotion of a cryptocurrency called EthereumMax (EMAX).

The lawsuit accused the trio of participating in a coordinated effort to inflate EMAX’s value through deceptive marketing tactics.

Critics argued that the celebrities, by endorsing EMAX without sufficient due diligence, misled investors about the potential returns and safety of the investment.

The lawsuit claimed that the orchestrated endorsements artificially drove up the token’s price, leading to steep losses for investors when the hype inevitably subsided.

The controversy sparked discussions among investors regarding the ethical responsibilities of high‑profile personalities when promoting financial products.

So, what can we learn from this?

The EthereumMax case underlines the immense responsibility that comes with celebrity endorsements.

It demonstrates how the impact of a well‑known figure can translate into significant financial decisions by the public—often without full disclosure of inherent risks.

Quick Tip: Never rely solely on celebrity endorsements when considering investment in emerging technologies, particularly cryptocurrencies. Do Your Own Research (DYOR):

Other Financial Disputes

Mayweather’s ventures have not been limited to the crypto sphere. Several other high‑profile disputes have also cast a shadow over his post‐boxing career.

The Logan Paul Payment Dispute

Following their 2021 exhibition match, controversy emerged when Logan Paul claimed that Mayweather owed him approximately $5 million from the fight’s proceeds.

According to Paul, this shortfall impacted his personal finances and larger business plans.

Claims centered around incomplete or delayed payments which, if proven, could have major contractual and reputational implications.

Mayweather publicly denied owing any additional sums, and the dispute remains emblematic of the complexities inherent in high‑stakes celebrity financial contracts.

Jewelry Fraud Lawsuit

In another legal twist, a Miami‐based jeweler filed a lawsuit in 2024 alleging that Mayweather had defaulted on nearly $4 million for luxury watches and diamond jewelry purchased in 2021.

The case, still unfolding, further illustrates the financial entanglements celebrities can face. The jeweler’s suit is centered on allegations of non‑payment for premium, high‑value items.

Such disputes not only tarnish reputations but also serve as cautionary tales for both businesses and investors to ensure contractual obligations are met.

Mayweather Real Estate and Tax Scams

While the majority of attention has been on crypto and sports endorsements, Floyd Mayweather’s ventures have also brushed up against real estate controversies.

One such case involves a high‑profile incident where Mayweather uncovered discrepancies in a property tax assessment during a real estate deal.

Here’s what went down:

In an attempt to acquire a multi‑million dollar Bel‑Air megamansion, Mayweather’s due diligence uncovered what appeared to be a systematic error—or worse, a deliberate scam—in the property’s tax evaluations.

This incident not only raised suspicions about the legitimacy of the property’s valuation but also shined a light on the broader issue of real estate tax fraud, prompting calls for increased transparency in property assessments.

So, whether in real estate or crypto, thorough due diligence is essential. Always verify property assessments and legal documents before making large‑scale financial commitments.

Visual Aid:

A flowchart detailing the process of due diligence in real estate transactions can serve as a practical guide for readers looking to better understand how to protect themselves against such scams.

Breaking Down the “Scam” Label: What Does It Really Mean?

The term “scam” is often over‑used and misunderstood. In the context of Floyd Mayweather’s post‑boxing financial endeavors, it’s important to distinguish between outright fraud, mismanagement, and cases of poor judgment in celebrity endorsements.

Clarifying the Terms:

- Fraud: In legal terms, fraud involves intentional deception for financial gain.

- Misrepresentation: Sometimes celebrities may inadvertently misrepresent products due to a lack of due diligence.

- Risky Endorsements: Endorsing unproven or volatile financial products can be seen as reckless—even if not intentionally deceptive.

The Fine Line for Celebrities

For a celebrity like Mayweather, whose endorsements carry vast influence, disclosure is critical. Regulatory bodies like the SEC insist on full disclosure to protect consumers.

Even if an endorsement is not fraudulent by intent, failure to communicate relevant risks may lead to legal repercussions.

More so, The public must be aware of these nuances and not simply assume that the involvement of a celebrity guarantees reliability or success.

Quick Tip: If a celebrity is promoting a financial product, look for disclosures regarding payment or compensation. Don’t rely solely on an endorsement.

How to Protect Yourself as an Investor

The controversies surrounding Floyd Mayweather’s endorsements offer valuable lessons for any investor:

Do Your Own Research (DYOR)

Whether you’re considering investing in cryptocurrency or buying real estate, always cross‑check information from multiple reputable sources.

Financial advisors and legal experts can help decipher the often‑complicated details of celebrity endorsements and related contracts.

Be Wary of Overhyped Endorsements

Before making any investment, ensure you fully understand what you’re investing in, including potential risks that might not be immediately apparent.

Red Flags to Watch For

🚩 Lack of Transparency: Failure to disclose compensation details is a significant red flag.

🚩 Unverified Claims: If an endorsement lacks supporting data or independent reviews, it could be a sign to proceed with caution.

🚩 Celebrity Hype: A celebrity endorsement can boost the popularity of a product, but it does not always ensure quality or legitimacy.

Impact on Celebrity Endorsements and the Financial Landscape

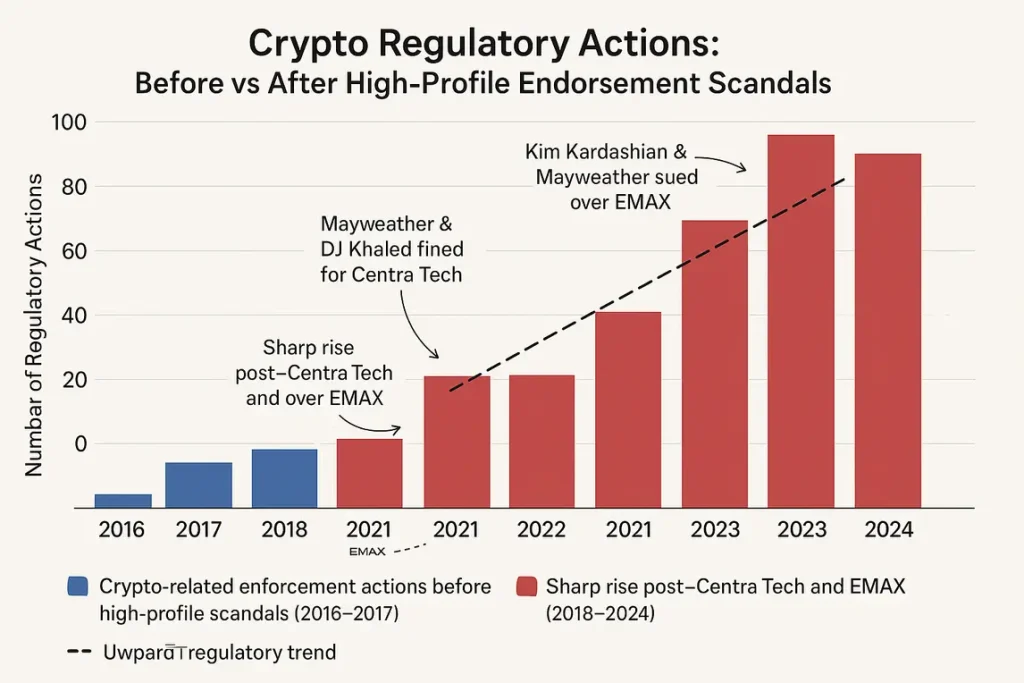

Floyd Mayweather’s controversies extend beyond individual lawsuits; they signal a broader trend in the world of celebrity endorsements:

In the wake of several high‑profile cases, regulators are increasingly scrutinizing celebrity endorsements. This has led to stricter guidelines on disclosure and transparency.

As regulatory bodies continue to enforce these rules, investors are becoming more cautious about high‑profile endorsements—seeking evidence of legitimacy before committing funds.

And this will have some future implications;

Both celebrities and investors are likely to adopt more rigorous due diligence processes. And also, brands and influencers may shift towards more transparent partnerships to avoid potential legal pitfalls.

In the long run, these changes could even lead to a more stable market environment where trust is rebuilt through accountability.

Conclusion

The saga of Floyd Mayweather’s financial controversies serves as a powerful reminder of the complex interplay between celebrity, finance, and regulation.

While his achievements in the boxing world remain undisputed, his post‑boxing business ventures have become a cautionary tale for investors and celebrities alike.

Whether you are endorsing a product or investing in one, clear communication and full disclosure must be at the forefront.

Relying solely on celebrity endorsements can be risky. Use independent sources to verify claims and always perform your own due diligence.

The legal and reputational impacts of controversial endorsements underscore the importance of aligning financial promotions with ethical and regulatory standards.

If you found this deep dive into the “Floyd Mayweather scam” insightful, don’t forget to share this article with fellow investors and enthusiasts.

This article was created by synthesizing data from reputable sources, including financial news outlets and regulatory announcements.

For Further Reading:

- Read a detailed account of the SEC’s actions on celebrity endorsements

- Insights on the EthereumMax litigation

- Read Logan Paul financial dispute

- Latest updates on real estate disputes